Introduction

By 2024, trends point to a significant change in French consumer habits.

In this article, we give you some pointers to understanding these new expectations and some solutions to meet them.

Apart from the underlying trend linked to inflation and the perception of declining purchasing power among the French, we have identified 3 underlying trends that are becoming clearer, with a "hat" trend: environmental commitment.

Environmental commitment has become an essential criterion for choice, with growing awareness of ecological issues and a desire to support brands and chains that adopt sustainable practices from production to distribution. In fact, 78% of the French are acting in favor of more sustainable consumption and integrating better practices for eco-responsible consumption in 2024(PropulseByCA). This trend is supported by an increase in purchases of sustainable and eco-responsible products, with a marked preference for quality over quantity.

The sleeping locavore awakens

Consumers give preference to products and services from their own region or country, encouraging short circuits and supporting the local economy.

In this respect, all chains now have a program to promote their local producers. This includes integrated chains like Carrefour, which give their outlets ample scope to source locally. Here are a few examples:

- Les Producteurs d'Ici by Intermarché within a 70-kilometre radius

- Local Alliances by Leclerc

- Carrefour des Producteurs by Carrefour

Ever closer, ever stronger

Directly linked to this idea of short circuits, proximity to the point of sale is also a key factor. In addition to the continuing dislike of hypermarkets with their plethoric offerings, consumers are looking for accessible and practical supply solutions that simplify their daily lives, thus favoring local store formats and fast delivery services. Favoring proximity over breadth of offer, even if it means multiplying the frequency of supply.

Illustration: Intermarché plans to open 300 convenience stores, mainly in urban areas, by 2030, with an ambitious target of 1.5 billion euros in sales within two years(LSA).

Let's lift the veil! The need for transparency

The Origine-Info project launched by Olivia Grégoire, the French Minister for Consumer Affairs, confirms a trend that is already well underway. It's worth noting here the notable media efforts of retail troublemaker Olivier Dauvers on the subject and his slogan "balance ton origine" ("balance your origin"). The cause is clear: consumers want greater transparency on the origin of the products they consume, particularly processed products, and naturally want to source locally as much as possible.

On this point, no retailer has yet taken any remarkable initiative. And that's a pity. With private label specifications directly in the hands of retailers, it would take very little for them to impose total transparency on their subcontractors. So it's up to the legislator to get to grips with the subject, after a small attempt to regulate certain products in the Egalim 1 & 2 law.

The marketer's headache

As we illustrated in a previous article, retailers are faced with a multiplication of consumer profiles. Urban or rural, young or old, each segment of the population is now adopting varied purchasing paths, often far removed from those observed just a few years ago. This transformation calls for adaptive approach strategies, capable of responding to the specific needs and changing expectations of these different audiences. Add to this the trend towards shorter distribution channels, greater transparency and healthier products... a real headache.

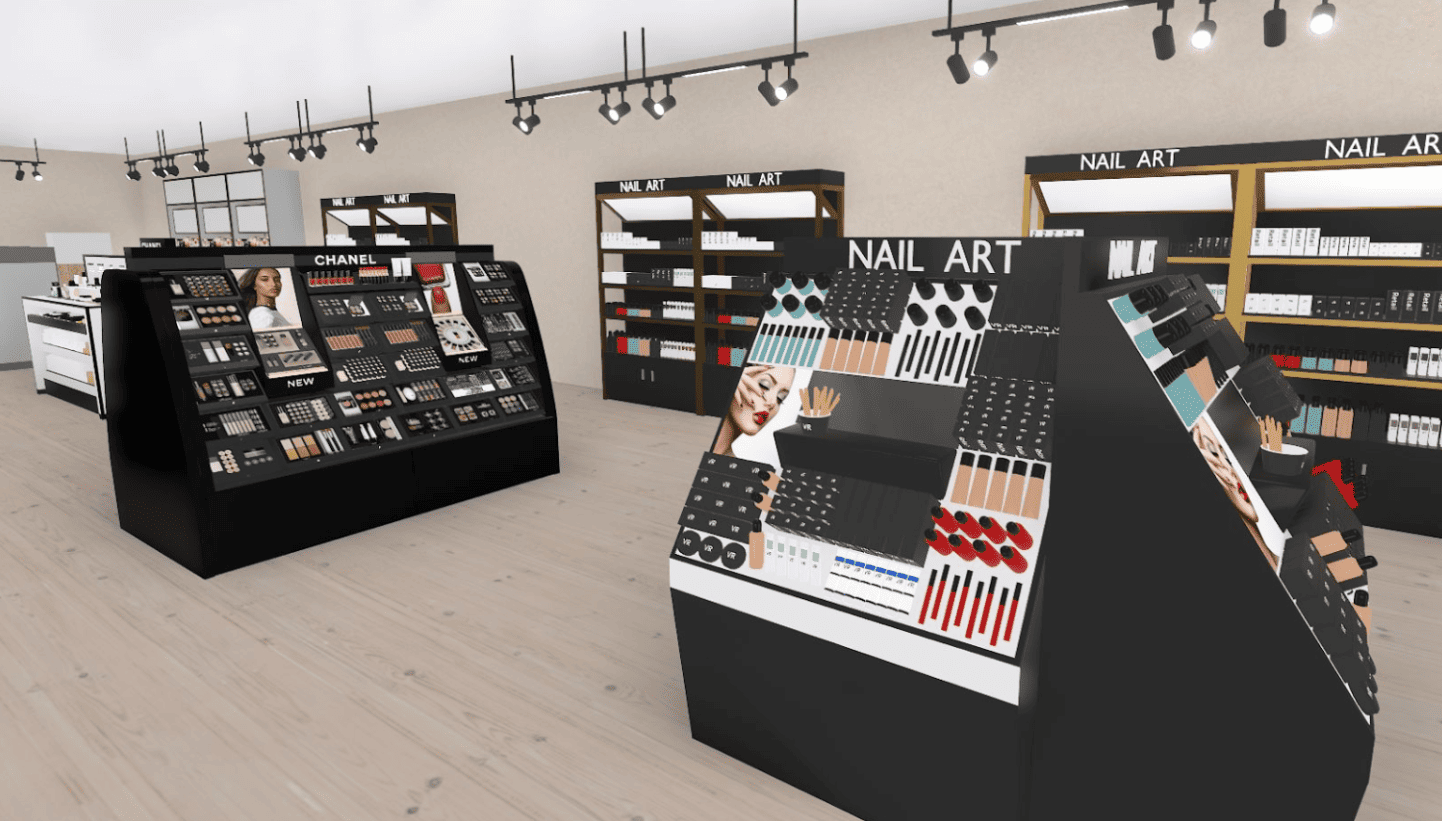

There are solutions for testing products and customer paths.

We're in a good position to tell you all about it, as Retail VR regularly collaborates with a number of renowned research institutes. ENOV, which specializes in "human-centered" marketing research, has worked on online shopper studies. We have also worked with Action Plus Shopper Research, experts in consumer behavioral research. Thanks to the virtualization of customer journeys, we can offer these institutes research tools that are easy to implement and just as effective as In Vivo studies. Read the testimonial to learn more about our partnership.

Watch the webinar we ran with Enov in January 2024 to learn more about shopper research and the benefits it can bring you, either as a manufacturer or as a retailer, for your product launches, or the implementation of customer journeys adapted to this hyper-segmentation.

%20(1).png)

.webp)

.webp)

.webp)